Poultry producers in the US have been told that if they have any thought of selling-up and leaving the sector, now is the time to do it, given that it will likely be more than a few years before industry conditions return to current levels.

That’s one of the key messages contained in a US-based chicken, cows and pigs report published by Rabobank.

While commenting that profit margins have generally been quite favourable for the US chicken sector over the last five years, the report’s authors warn that the new few years don’t look so good.

“While we don’t foresee (chicken) margins falling to the lows of 2008 and 2009, as prices decline through 2018, any producer considering a possible sale or divestiture should move quickly,” they say, adding that the outlook for margins and valuation multiples isn’t moving in the sector’s favour.

Looking at the other side of the same picture, however, the Dutch-based intrernational bank encourages would-be business developers to stay patient.

In a section headed “Paths to success for US animal protein”, the report includes the sub-heading that “bigger is better” when looked at in relation to the future consolidation of the industry.

“Consolidation opportunities are expected,” they state, “especially in pork processing and chicken production. Those with an acquisition appetite, however, will need to show restraint and wait for the cycle to begin to play out in order to take advantage of more attractive valuations.”

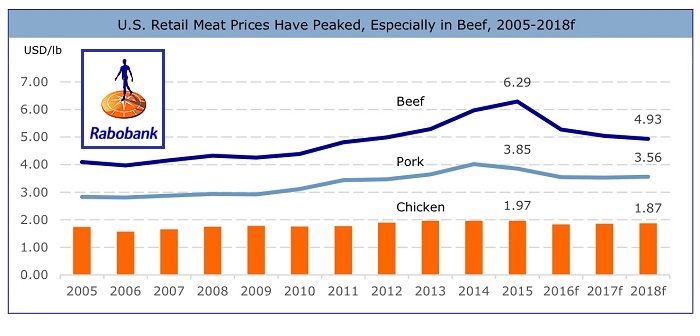

The cycle referred to, concerns the forecast changes set to unfold between now and the end of 2018, which Rabobank sees as featuring a 2.5% growth in US protein production (down from 3% in 2015), with beef being the largest contributor, relative to pork and poultry.

“Trade appears to have stabilised in 2016, so far,” the report continues. “However, we don’t foresee international markets absorbing all of this production growth, thus requiring further increases in domestic consumption. This will continue the upward trajectory of US protein consumption toward the all-time peak of the mid-2000s, which will ask a lot of US consumers and will come at the cost of lower prices.

“By the end of this expansion cycle in late 2018, we expect a more challenging profit environment across the US meat industry, providing strategic opportunities for those producers with the capital and foresight to take advantage of them.”