The proportion of consumer spend at UK supermarkets that goes on items on promotion has hit its lowest level in 11 years, according to Nielsen retail data released today.

In the four weeks ending 25 March 2017, just over a quarter (26%) of spend at UK supermarkets went on products with temporary price cuts or multi-buy offers, the lowest level since 2006 (also 26%).

The reduction in promotional spend is happening across all categories but is much faster in supermarket’s own or private label spend (just 18% of sales in the last year went on promotional spend) than among sales of branded goods (41%).

“The level of promotional spend has gone back to levels not seen since before the 2008/09 economic crisis,” observes Mike Watkins, Nielsen’s UK head of retailer and business insight. “The last few years, have seen about a third of the typical supermarket shopping bill going on promotional items. However, to be more price competitive, supermarkets have turned temporary price reductions into permanent cuts, so there’s less promotional activity as many prices are cheaper all-year round.

“There’s also been a shift away from multi-buy to simpler price cuts, which is in tune with shopper needs to make it easier to manage their basket spend.”

Overall, year-on-year takings at supermarket tills during the four weeks ending 25 March fell -2.6%¹ as the timing of Easter this year negatively affects comparative sales.

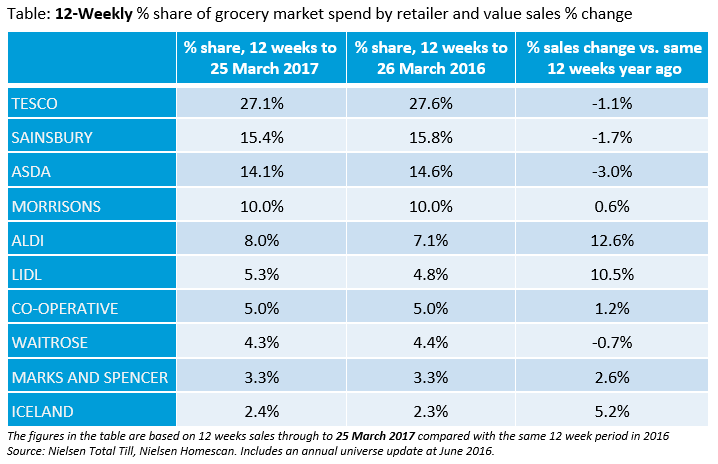

In terms of individual supermarkets outside the discounters, Iceland was the best performer over the last 12 weeks in terms of year-on-year sales (up 5.2%), followed by Marks & Spencer (+2.6) and the Co-operative (+1.2%), while Morrisons was the only one of the Big Four to see year-on-year sales rise (+0.6%).

“Looking ahead, supermarket growth will come from exploiting the “little and often” shopping trend , product innovation including private label and food to go, as well as maximising sales during seasonal events such as Easter,” concludes Watkins. “Supermarkets are well placed to fulfil these mission-based shopping trips and increase total store spend through different and larger store formats which highlight the breadth of range not available at a discounter. This is particularly important with many retailers reviewing business models in light of the shift to omni-channel retailing.”